We buy various things online and make payments using globally recognized financial services like Stripe or Paypal. Almost every country in the world has the advantage of these two payment processing systems. So it goes without saying that if you want to open an online store, having one of these two payment systems is essential, and having two is best.

In today's article, we will try to make you understand how these two payment processing platforms work and in which case which one should be used. Also, we'll try to know about key differences between them. So, let's jump right into the article.

What is Stripe

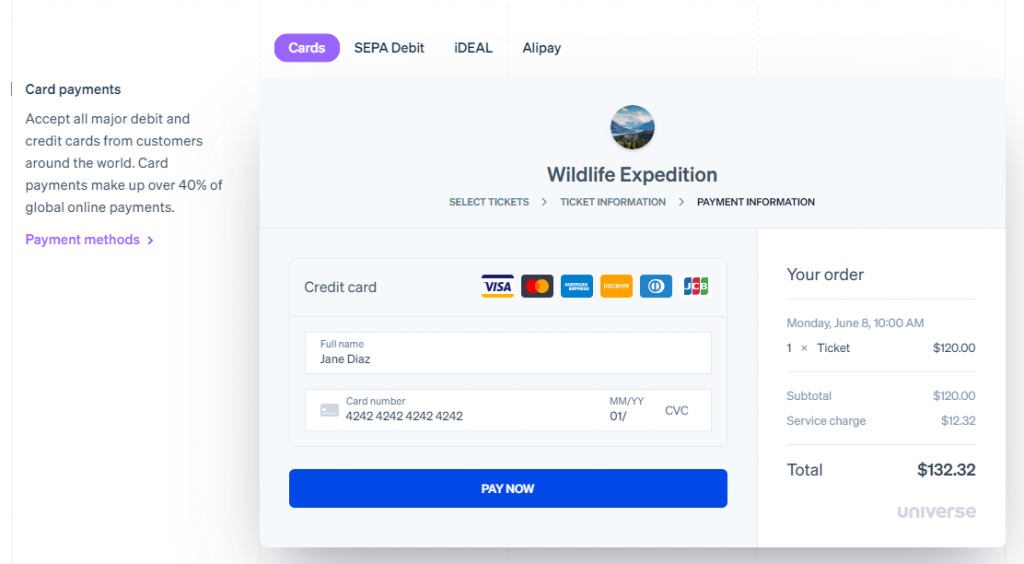

Stripe is a full-stack payment processor for your business. Many sellers around the globe are turning to Stripe to simplify their small-business checkout process. It's a safe and efficient fund transfer module. It also includes invoicing and billing software along with fraud risk management and process sales tax.

This is how it works

Create Amazing Websites

With the best free page builder Elementor

Start Now- After opening an account, it connects to your business purchasing page.

- Customers input their financial info to the purchese page.

- From the purchase page, those informations are sent directly through Stripe software to check funds availability and then it process the payment for sending into marchent account.

- As soon the marchent receives the payment, a sale confirmation report generates and sent to the both marchent and buyer.

Stripe supports Apple pay, Google pay, or WeChat pay, so buyers can pay using these modules and you can still receive funds directly on your bank via stripe. It costs 2.9% plus $0.30/ Per transaction for credit cards and wallets. For bank debits, the charge is 0.8% plus $5.

Stripe is a multifunctional payment processing system loved by users but its only limitation is - availability in only 44 countries.

What is PayPal?

PayPal is a widely appreciated online financial service that lets you make a secure online transaction. You can receive and make payments through PayPal and withdraw money from the bank. It's the easiest and quick way to send and request money online. There are more than 400 million active PayPal account holders around the world.

Paypal has different modules for business and individual accounts. For a business account, you'll the services like -

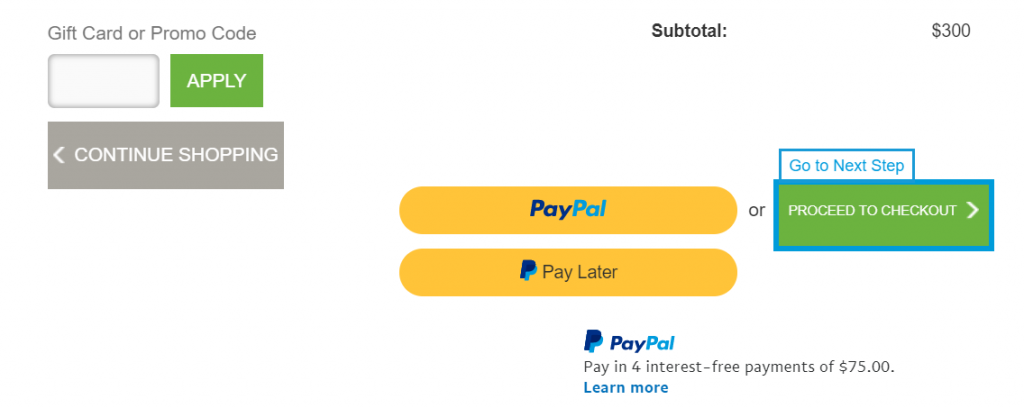

- Your users will be redirect to the platform through PayPal payment button.

- You can add custom PayPal checkout module.

- Customers can select between credit and debit cards, PayPal balances, or make direct bank transfers.

- Support for one-off and recurring payments

- Variable withdrawal options depending on your location

PayPal is available in 161 countries means you can do business in almost every country in the world.

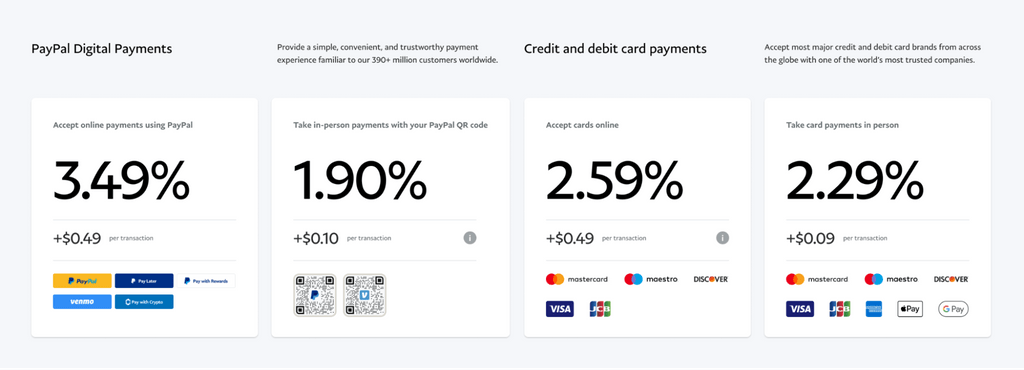

It charges 3.49% plus $0.49 for credit card transactions for a merchant account. For international purchases, the service charges an additional 1.50%.

Key Differences: Stripe Vs PayPal

There is no limitation of perfection. There are so many payment services out there and still, many business owners are hesitant to make a choice selecting the right payment module. To solve this dilemma, we came up with 4 key differences that will help you to decide.

Usability

Paypal is easy to singing up and the account management is very simple. The dashboard is very user-friendly and even non-technical people feel comfortable with it.

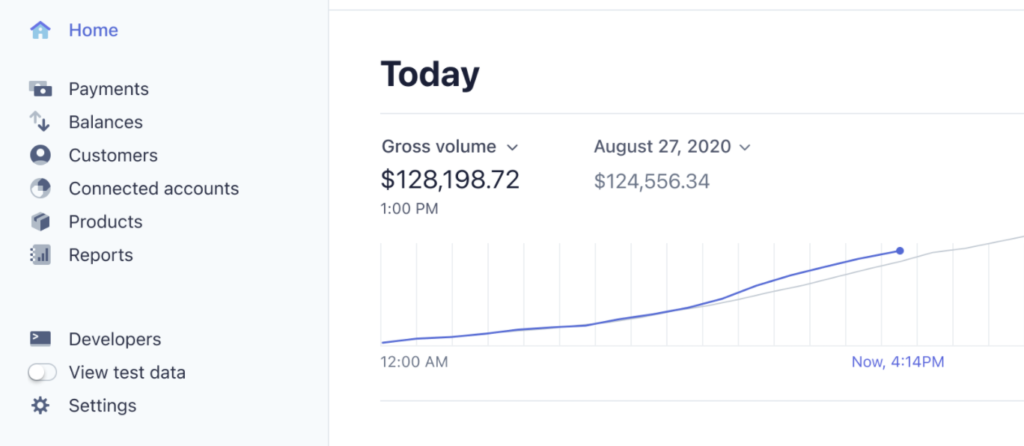

On the other hand, Stripe's command center is much more complex. You can manage 3rd party plugins from the dashboard and get a hand on the reports, developer tools, and sample data.

Setting up a payment solution for your online store is very simple on both PayPal and stripe. PayPal gives you an advantage by letting you set up a "Buy Now" and custom "Checkout" button.

You can not add a button for Stripe without the help of a developer. But this payment service lets you have more control over the entire checkout process.

WordPress has a vast library of eCommerce plugins that support both Stripe and PayPal. So you can add one of these or both to make transactions simpler for your customers.

Availability And Dual Currency Support

Paypal is a universally available payment process that can be accessed from 161 countries. So, it has a distinctive local advantage in most of those countries. But few of those countries aren't getting full range services from PayPal.

For example, users from 83 countries cannot receive funds, Customers in such places as Bolivia, Paraguay, and Aruba can only pay using Credit Card. Paypal only accepts 25 currencies. So for other currencies, there is 2.5% conversion rate applies.

Meanwhile, Stripe can be accessed from 44 countries but it supports 135 currencies with a 1% conversion rate for overseas payments.

Both of these payment modules have their benefits. So, if you want to do business in a global market, you have to make sure that your customers can pay you through other payment methods in case these two are not available.

Pricing And Plans

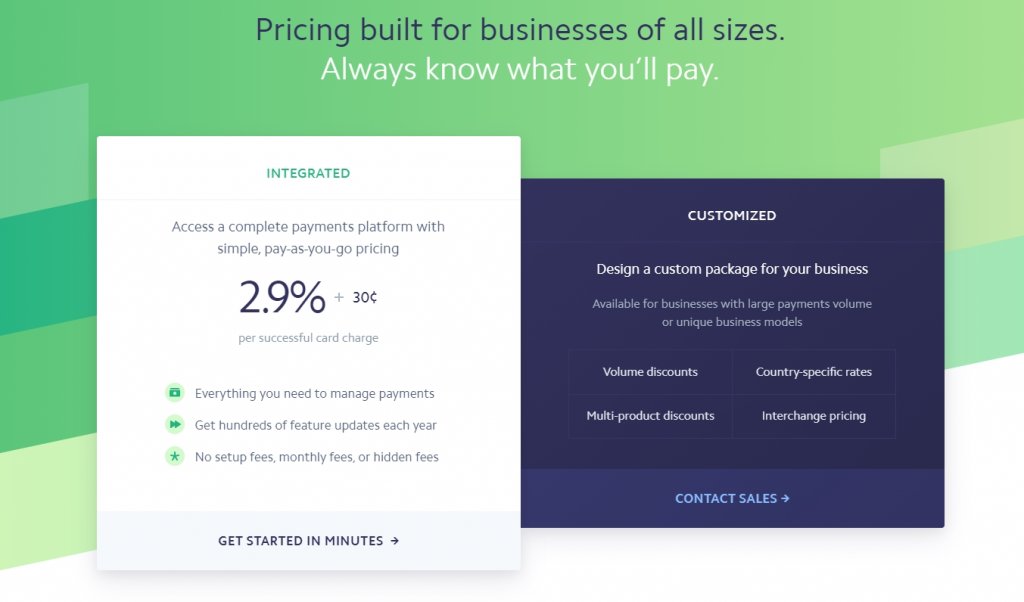

It's free to use both Stripe and PayPal means you can get your hands on the account for no cost. You can select between integrated and customized accounts from Stripe. The price table for these accounts are -

Stripe doesn't have any hidden charges and the pricing stated here is pretty straightforward. Note that, You can use a Stripe business account with a lower price for a significant number of transactions.

PayPal has two plans and it's a bit more complex.

- PayPal Payment Starderd - Its a free basic plan that redirects to offivial PayPal website to finish transections.

- PayPal Payemnt Pro - Comes with a $30/Per month maintainance free that allows you to set custom checkout page on your website and let you handle sales from phone/virtual terminals.

Both services cost 3.49% plus $0.49 for card transactions and 1.5% for international sales. Paypal also supports local payments methods since its available in 161 countries.

Stripe has the edge because it offers integrating payment flows via the website by its integrated plan. On PayPal, you need to back off from the pro plan for this. Conclusively, both these modules have almost the same fee system.

Payment Methods

Credit card processing is the focus functionality for both of these platforms because most of the users make payments via credit card.

In case if someone doesn't want to use their credit card and wishes to make payments from bank accounts - both platforms allow that too. For customers who are using smartphones, can use their "Wallet" to make payments.

| Payment Methods | Stripe | PayPal |

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Debit | Yes | Yes |

| Digital Wallet | Yes(Apple Pay, Google Pay, Wechat Pay, Ali Pay, Microsoft Pay, Mecado Pago) | Yes (Only Venmo) |

| Cryptocurrency | No | Yes |

| In-platform loans or Credit | Yes | Yes |

Stripe is more supporting side by when it comes to bank debits and digital wallets where PayPal only supports Venmo that is available for the US only. Again, Cryptocurrency is not available on Stripe but PayPal is allowing US users to make purchases via digital currencies.

Wrapping Up

If you want an expert opinion, we will say that Stripe and PayPal, both payment methods should be used on your website. This will give your customers options to make payments which will increase the reliability of the business. Since Stripe is not available in many countries, it will be convenient for customers to integrate with other payment processes using PayPal. PayPal is the number one choice if you only want to do business in the US because PayPal has the most benefits in the US region, but if we think of features and dual currency support, Stripe will be ahead.